Week 21 – Pay Yourself First – Savings Account

Just like this should have been written much earlier in this book, a savings account should have been established much earlier in my life. While my parents always taught me to pay myself first, I always found better uses for my money. And since I have so much credit card debt, it made it equally as difficult to put money away. Paying down debt is still the first priority, but it is also important to have savings. Whether it is for emergencies, college funds, or retirement everyone should have some type of savings in place to protect your current assets, your family and your future. We unfortunately do not have a savings, but my husband and I do contribute to our 401K accounts. In the past year, we reduced our weekly contributions to our 401K accounts in an attempt to pay off debt. However, when we get our annual raise, we take a portion and apply it directly to our retirement accounts. The earlier you start the better.

If you do not have a savings account, you should set something up as soon as possible. This should be separate from your “rainy day” fund so that you are not tempted to dip in. If possible, have a portion of you paycheck directly deposited into this account so that you don’t even see the money. Slowly increase the amount over time as you financial circumstances improve.

Over the course of a year, we had $2,000 in savings and planned to at least double it the next year!

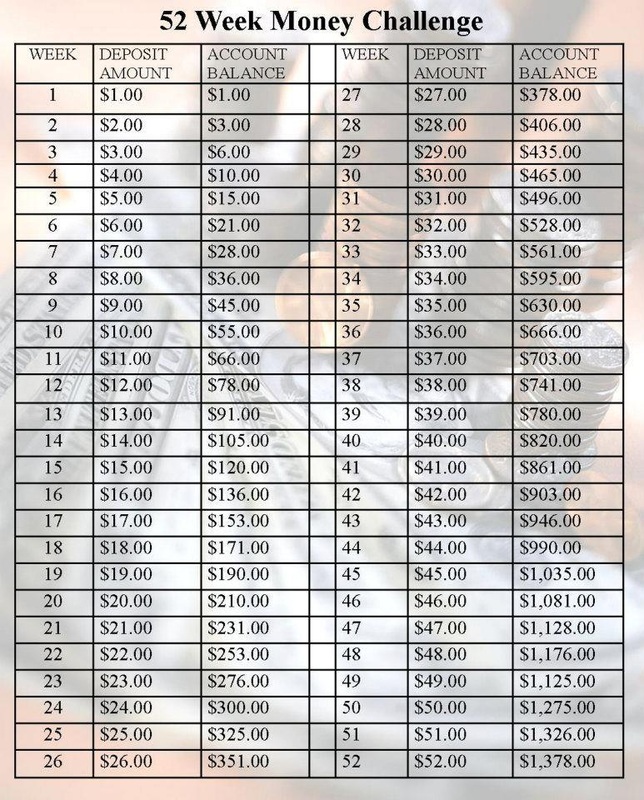

Another saving challenge that I recently came across was the 52 Week Money Challenge. I think this is an easy way to get started and it's a good example of how quickly your money can grow, even in small increments.

All data found on this website is Copyrighted by MOMTHATSAVES. Unauthorized reproduction is prohibited.

Just like this should have been written much earlier in this book, a savings account should have been established much earlier in my life. While my parents always taught me to pay myself first, I always found better uses for my money. And since I have so much credit card debt, it made it equally as difficult to put money away. Paying down debt is still the first priority, but it is also important to have savings. Whether it is for emergencies, college funds, or retirement everyone should have some type of savings in place to protect your current assets, your family and your future. We unfortunately do not have a savings, but my husband and I do contribute to our 401K accounts. In the past year, we reduced our weekly contributions to our 401K accounts in an attempt to pay off debt. However, when we get our annual raise, we take a portion and apply it directly to our retirement accounts. The earlier you start the better.

If you do not have a savings account, you should set something up as soon as possible. This should be separate from your “rainy day” fund so that you are not tempted to dip in. If possible, have a portion of you paycheck directly deposited into this account so that you don’t even see the money. Slowly increase the amount over time as you financial circumstances improve.

Over the course of a year, we had $2,000 in savings and planned to at least double it the next year!

Another saving challenge that I recently came across was the 52 Week Money Challenge. I think this is an easy way to get started and it's a good example of how quickly your money can grow, even in small increments.

All data found on this website is Copyrighted by MOMTHATSAVES. Unauthorized reproduction is prohibited.